3585 S Church St, Whitehall, PA

3585 S Church St, Whitehall, PA 18052

Industrial

Lease

Sublease

504,900 sq ft

Del Markward, SIOR

610.295.6603

610.295.6603

Mike Capobianco, SIOR

610.295.6607

610.295.6607

Dutch Markward

610.295.6610

610.295.6610

Location

Lehigh County | Whitehall, PA

Lehigh Valley Industrial Cluster

Close to Route 145 and Route 22

Features

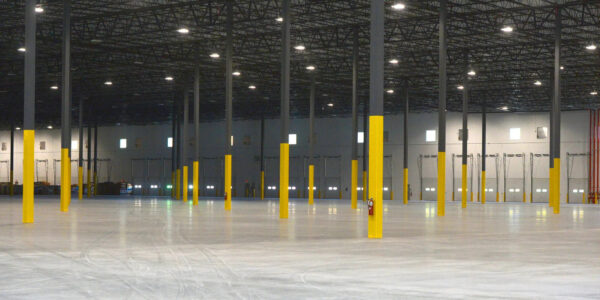

504,900 SF | Industrial

Features:

- 504,900 SF

- 40′ Ceiling Height

- 90 Loading Docks

- 4 Drive-In Docks, 12′ W x 14′ H

- 354 Parking Spaces

- Sublease

Broker

Del Markward, SIOR

Development / Investment / Retail

Del has owned and operated Markward Group, a real estate consulting, advisory, and brokerage firm since 1995. He has represented and transacted with some of the largest companies in the world, including Coca-Cola, Microsoft, GE, Chrysler, Pepsi, GM, Dun and Bradstreet, amongst others. Del also operates Caracor, LLC, a real estate development and investment firm, focused on mixed-use, industrial parks, and senior living projects. Del is on the Executive Board of Directors and the former (2018) Global President of SIOR (Society of Industrial and Office Realtors) a distinguished designee organization of affiliated professionals focused on maintaining the highest standards for commercial and industrial real estate globally.

Mike Capobianco, SIOR

Industrial

Mike Capobianco joined the Markward Group late in 2016 after a tenure at Colliers. He also worked with NGKF and before that at Liberty Property Trust (LPT). With Markward Mike is Senior Managing Director.

He brings a strategic platform to industrial distribution centers and manufacturing. Conducting his business calls him to focus on Logistics & Transportation (Supply Chain) Optimization. He has worked both sides of transactions with Developers and Owners resulting in leasing and purchasing of facilities or land and with Users, Tenants, and Buyers. Given his experience with LPT, he is well versed in construction costs and build-to-suit analysis. He is customer-centric and has completed leases and sales ranging from 25,000 SF to 800,000 SF. His customers have included Amcor Rigid Plastics, Crayola, Kane Distribution, Kehe Distributors, UPS, Garden Pet & Supply, Master Halco, New Boston Fund, Majestic Realty, First Industrial, Prologis and LPT to name a few in the Industrial Sector. His average transaction square footage (SF) is 381,375 SF.

Mike’s awards include LPT "Broker of the Year", Board of Realtors' award for "large regional deal", Colliers Philadelphia Award for "highest volume increase," Co-Star "Power Broker" and Colliers International "Corporate's Largest Deal of the Year".

He is an active member of the Society of Industrial & Office Realtors (SIOR) where he has served globally in many positions including member of the Board of Directors and Chair in the SIOR Foundation.

Mike has a B.S. in Economics from the Wharton School at Penn. Volunteer work includes Safe Harbor, Boys & Girls Club, Morningstar Senior Living, and he is a Trustee with his church.

Dutch Markward

Industrial

Dutch Markward is a Managing Director at Markward Group, where he focuses on industrial real estate throughout central and eastern Pennsylvania. Dutch brings a strong financial foundation from his prior experience in public accounting and consulting. After earning both his B.S. and Master’s in Accounting from Penn State University, he spent several years auditing public companies at EY before transitioning into accounting consulting. This background gives him a unique edge when advising clients, he approaches each transaction with a deep understanding of financial statements, operational efficiencies, and risk analysis.

Dutch is particularly focused on helping industrial users, owners, and investors navigate complex deals with clarity and confidence. His analytical mindset, paired with a growing command of the regional industrial market, allows him to deliver thoughtful, data-driven solutions. He’s also a digital native in many ways, comfortable leveraging technology for outreach, market insights, and deal marketing. Whether guiding clients through acquisition, disposition, or lease negotiations, Dutch combines financial insight with a relationship-first approach rooted in transparency and long-term thinking.